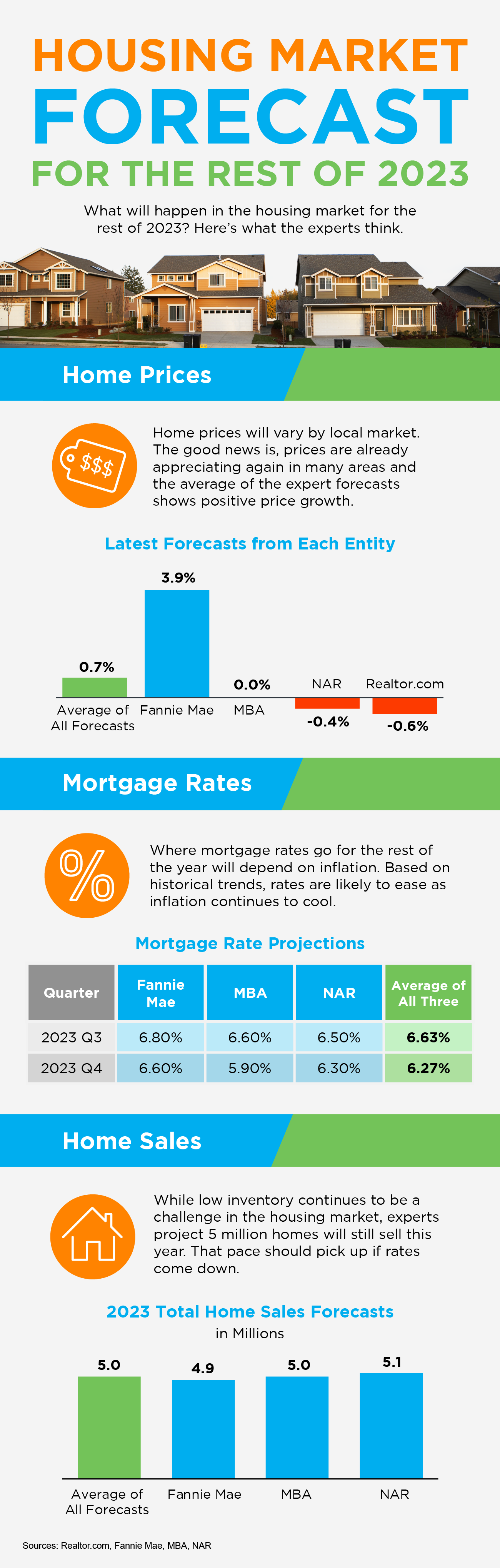

Housing Market Forecast for the Rest of 2023

Found 32 blog entries tagged as "buyers".

Many homeowners thinking about selling have two key things holding them back. That’s feeling locked in by today’s higher mortgage rates and worrying they won’t be able to find something to buy while supply is so low. Let’s dive into each challenge and give you some helpful advice on how to overcome these obstacles.

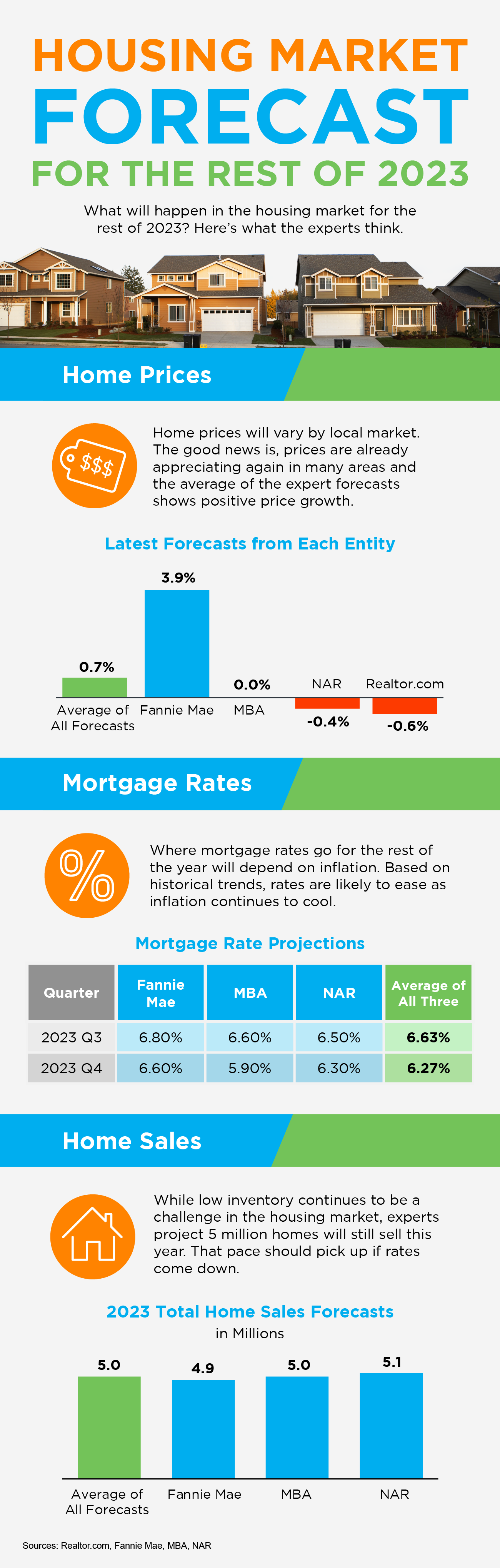

According to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4% (see graph below):

But today, the typical 30-year fixed mortgage rate offered to buyers is closer to 7%. As a result, many homeowners are opting to stay put instead of moving to

But today, the typical 30-year fixed mortgage rate offered to buyers is closer to 7%. As a result, many homeowners are opting to stay put instead of moving to

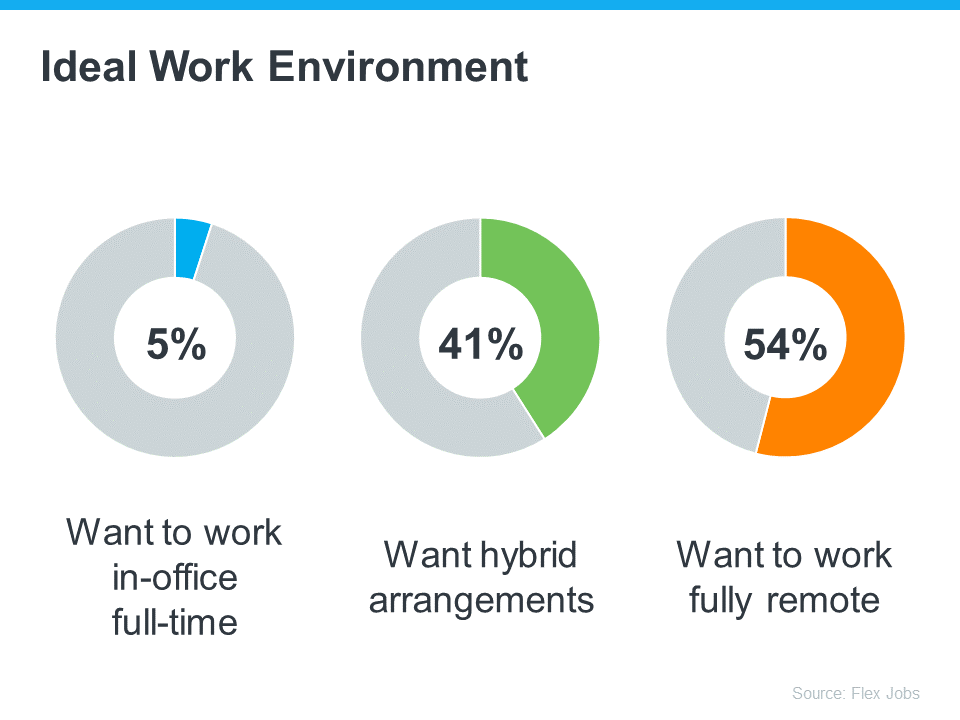

Even as some companies transition back into the office, remote work remains a popular choice for many professionals. So, if you currently enjoy working from home or hope to be able to soon, you’re not alone. According to a recent survey, most working professionals want to work either fully remote or hybrid (see below):

This trend is good news if you’re looking to buy a home because a remote or hybrid work setup can help you overcome some of today’s affordability and housing inventory challenges.

Remote or hybrid work opens up a world of opportunities. That’s because it allows you to broaden your search for your next home since you’re no

…

June 13, 2023

For BuyersFor SellersInterest RatesMove-Up BuyersIf you’re thinking about selling your house right now, chances are it’s because something in your life has changed. And, while things like mortgage rates are a key part of your decision on what you’ll buy next, it’s important to not lose sight of the reason you want to make a change in the first place.

It’s true mortgage rates have climbed from the record lows we saw in recent years, and that has an impact on affordability. With rates where they are right now, some homeowners are deciding they’ll wait to sell because they don’t want to move and have a higher mortgage rate on their next home. As Danielle

…

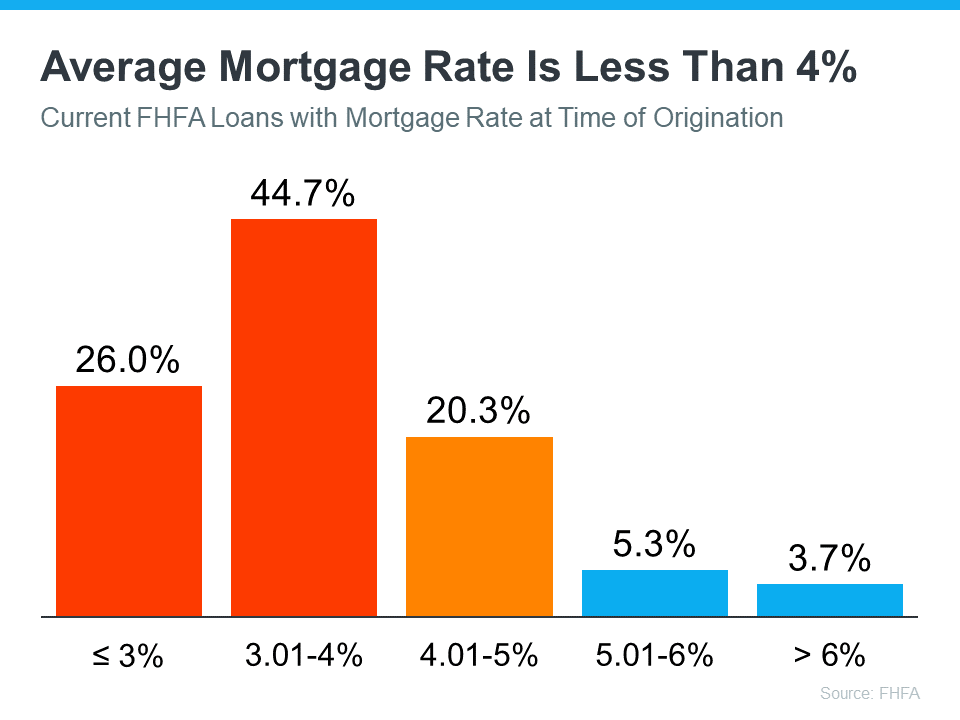

Media coverage about what’s happening with home prices can be confusing. A large part of that is due to the type of data being used and what they’re choosing to draw attention to. For home prices, there are two different methods used to compare home prices over different time periods: year-over-year (Y-O-Y) and month-over-month (M-O-M). Here's an explanation of each.

If you’re thinking about selling your house right now, chances are it’s because something in your life has changed. And, while things like mortgage rates are a key part of your decision on what you’ll buy next, it’s important to not lose sight of the reason you want to make a change in the first place.

It’s true mortgage rates have climbed from the record lows we saw in recent years, and that has an impact on affordability. With rates where they are right now, some homeowners are deciding they’ll wait to sell because they don’t want to move and have a higher mortgage rate on their next home. As Danielle Hale, Chief Economist at Realtor.com, explains:

“. . . homeowners who locked in…

May 3, 2023

For SellersHousing Market UpdatesSelling MythsIf you’re a homeowner thinking about making a move, you may wonder if it’s still a good time to sell your house. Here’s the good news. Even with higher mortgage rates, buyer traffic is actually picking up speed.

Data from the latest ShowingTime Showing Index, which is a measure of buyers actively touring homes, helps paint the picture of how much buyer demand has increased in recent months (see graph below):

As the graph shows, the first two months of 2023 saw a noticeable increase in buyer traffic. That’s likely because the limited number of homes for sale kept shoppers looking for homes even during colder

…

April 10, 2023

For SellersHousing Market UpdatesThe spring season appears to be warming up in housing as more and more buyers enter the market. And after rising mortgage rates sidelined so many buyers last year, that’s a good sign for sellers. Realtor.com has the latest:

“Spring is officially here, and like green shoots emerging from the bleak winter, new data suggests that more buyers are back in the market, although more subdued compared to a year ago.”We know buyer activity is trending up because of mortgage purchase application data. According to Investopedia:

“A mortgage application is a document submitted to a lender when you apply for a mortgage to…We feel this “buying season” for homes is shaping up to be one of the best in years with buyers looking to take advantage of the still low interest rates and sellers expecting to get the highest prices for their homes as inventories are still low and home prices are still rising. Look no further than Fannie Mae for substantiation of this confidence in housing.

Americans More Confident in Housing Than Ever Before

Americans are more confident about their housing prospects than ever before, with more believing now is “a good time” to buy or sell a home, according to the just-released Fannie Mae Home Purchase Sentiment Index® (HPSI), which hit high point after high point in February.

“The latest post-election surge in optimism puts the HPSI at its

…